The policy interest rate is Banco de la República’s main monetary policy instrument. The Bank raises, lowers, or maintains it with the aim of achieving the annual inflation target, which, in Colombia, has been set at 3.0% since 2010.

Banco de la República’s policy interest rate is currently 9.25%. The policy interest rate serves as the benchmark that the Bank uses to lend to or borrow from commercial banks over very short terms. As with other central banks worldwide, it is the main policy instrument used to achieve the annual inflation target. The inflation target represents the goal established by the authorities, and in Colombia it has been set at 3.0% since 2010.

The Board of Directors of Banco de la República (the Central Bank of Colombia) makes decisions regarding the policy interest rate (whether to raise it, lower it, or keep it unchanged), thereby influencing other interest rates in the financial market. This, in turn, affects household consumption, business investment, the US dollar exchange rate, and the expectations of businesspeople and analysts about how prices will evolve in the future.

When consumption, investment, and exports (i.e., demand) exceed the productive capacity of the economy (i.e., supply), upward pressures on prices emerge, which central banks can moderate by raising their policy interest rate. These increases are effective in moderating price rises as borrowing becomes more expensive, and savings become more profitable than spending. Additionally, the US dollar tends to weaken as more foreign capital flows into the country, since peso-denominated investments become more attractive. Equally important, those who set or negotiate prices and wages in the economy recognize that the Central Bank adjusts its policy interest rate to bring inflation to the target, which causes prices and wages to align with it.

At Banco de la República, as well as in other central banks that operate under an inflation-targeting framework, decisions regarding the level of the policy interest rate are aimed at guiding the economy toward the inflation target, while seeking to avoid excessively large increases in spending by firms and households as well as sharp declines in spending and significant job losses.

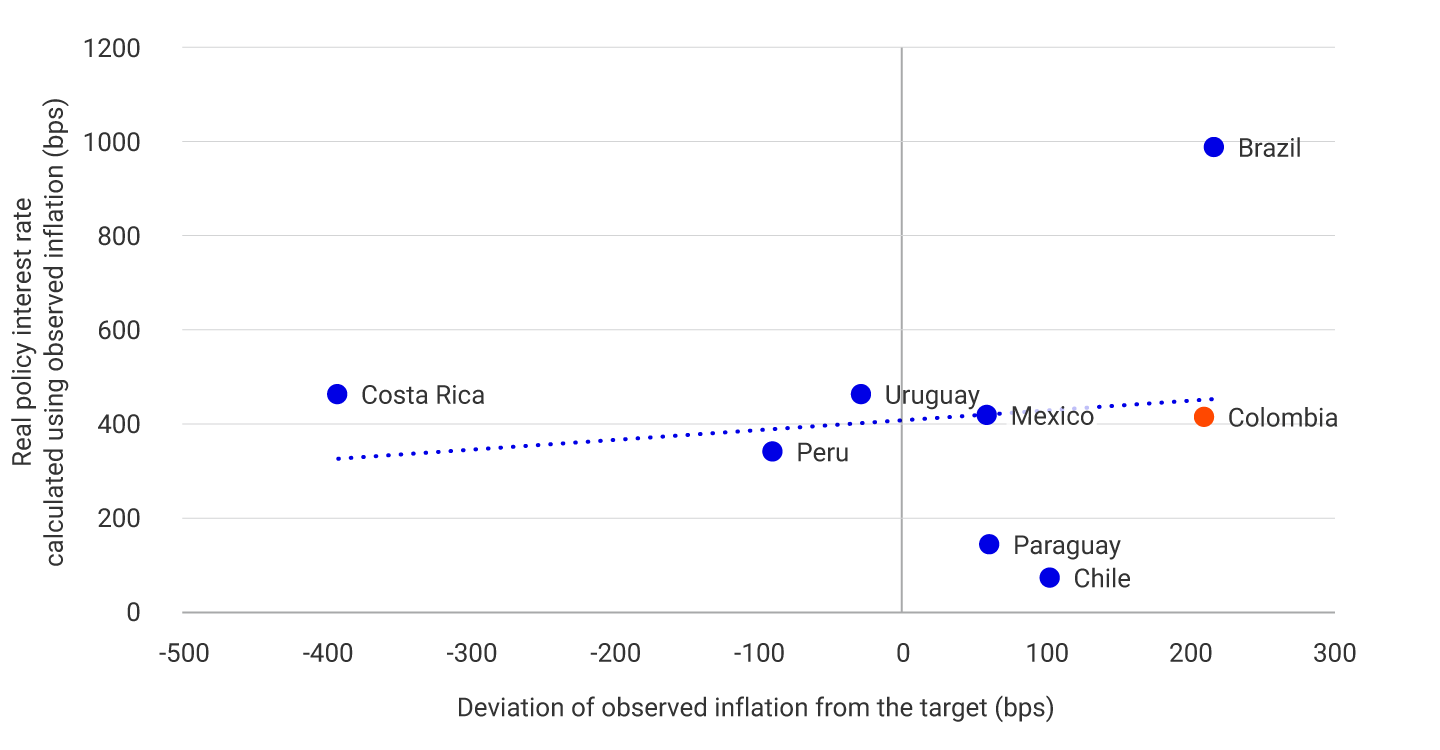

In this context, Banco de la República’s policy interest rate (as those of other central banks worldwide) responds, among other factors, to the difference between observed inflation (the one that has already occurred) or expected inflation (the one anticipated to occur in the future, referred to as inflation expectations), and the inflation target. The greater the distance between these inflation measures and the target, the greater the effort required by the Bank to reduce it.

How can this effort be measured? Typically, the real interest rate is used, that is, the difference between the policy interest rate and inflation. Inflation is subtracted to consider that, for example, what matters to a saver is what they can purchase with the return on their investment. The interest rate may be high, but if inflation is also high, the purchasing power of the returns on that investment is lower than it would be if inflation were lower. For this reason, a proper comparison of interest rates across countries with different inflation levels requires subtracting inflation from the interest rates.

In Graph 1, we compare the differences between observed inflation and the target in eight countries in the region with a similar monetary policy to Colombia's, along with their levels of real interest rates calculated as the differences between the respective policy interest rates and observed inflation. As shown in the graph, there is a positive relationship between the policy interest rate measured in real terms (on the vertical axis) and the deviations of observed inflation from the target (on the horizontal axis). In other words, in economies where inflation tends to deviate from its target, central banks set higher real interest rates. This occurs precisely because central banks make decisions that respond to their primary objective of controlling inflation.

In this context, it can be observed that Banco de la República’s performance is not different from what was expected. The real interest rate in Colombia is higher than that of countries whose inflation is closer to the target, such as Paraguay or Chile, or even below it, such as Peru. Meanwhile, Colombia's real interest rate is considerably lower than that of Brazil, whose inflation rate is further from the target compared to Colombia. In this regard, it can be expected that when a low and stable inflation rate is achieved, the policy interest rate will also be lower. It is interesting to note, in any case, that the current real interest rate in Colombia does not differ significantly from that in Uruguay or Costa Rica, although inflation is close to the target in the former, and in the latter, it is considerably below it.

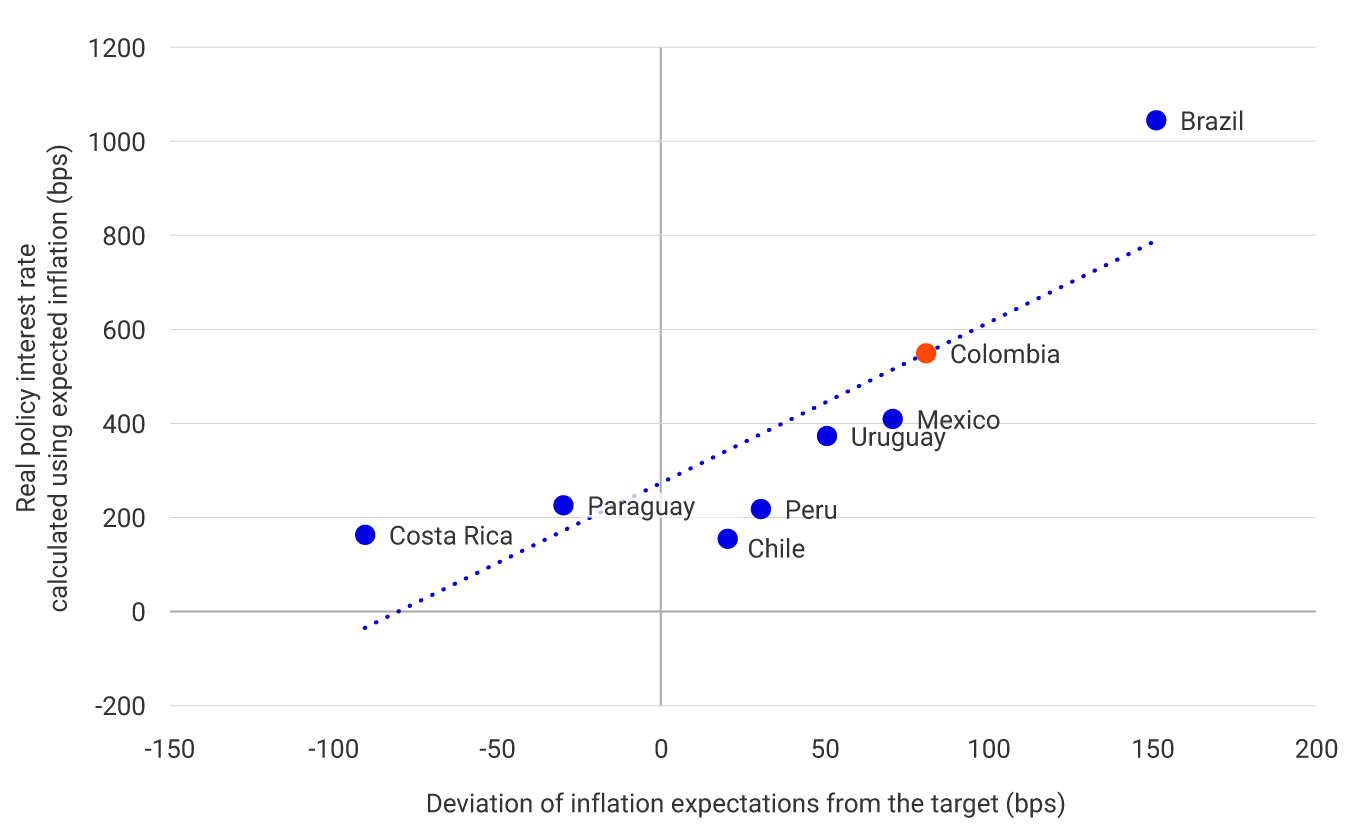

These calculations were made using real interest rates considering observed inflation. However, central banks are concerned not only with deviations of inflation from the target, but also with the gap between inflation expectations and the target. This is because those who set or negotiate prices and wages in the economy consider what they expect inflation to be in the future. Thus, for example, from a saver’s perspective, what matters is the quantity of goods and services that the return on their savings will allow them to purchase in the future, which is measured by expected inflation rather than observed inflation. For the same reason, the real interest rate calculated using expected inflation may be the most relevant for someone taking on debt.

Graph 2 shows that this is the case for the same group of countries as in Graph 1. In this case, real interest rates are calculated considering expected inflation and are compared with the differences between inflation expectations and the target. It can be observed that central banks facing a larger gap between expected inflation and their target have higher real interest rates.

As can be observed, the case of Colombia is typical within the group of countries considered. According to this measure, Colombia has a level of the real interest rate consistent with its difference between inflation expectations and the target, significantly lower than that of Brazil, and close to that of Mexico and Uruguay.